Mastering Month-End Billing: Optimizing High-Volume Proforma Review

Share This Article

Optimizing the monthly proforma review cycle for law firms managing substantial billing volumes can be one of the most challenging operational processes. Consider implementing a pre-bill automation solution that enables your firm to leverage the learnings outlined in this article. This guide provides proven strategies and practical insights to help streamline your month-end billing while maintaining accuracy and client satisfaction.

Focus on the 80/20 Rule

When improving billing efficiency, focus on your core billing workflows, representing approximately 80% of your monthly volume. While every firm has unique requirements and edge cases, prioritizing improvements to your standard billing processes will deliver the quickest wins and largest impact.

Some practice groups may have specialized billing needs, while others follow more standardized, transactional patterns. Begin by identifying those standardized workflows where process improvements will benefit the largest number of timekeepers and matters.

Designing Efficient Data Flows

Establishing clear processes and expectations is the foundation of efficient month-end billing. The first critical step is setting and communicating timelines that work for all stakeholders.

Setting Clear Timelines

Most firms generate proformas on the second business day of each month, followed by ad hoc generation throughout the month based on attorney requests or billing thresholds. Establishing clear deadlines for attorney review and return of proformas is critical for maintaining efficient billing cycles.

Some key considerations for setting timelines:

- Be explicit about when proformas need to be returned (e.g., by the 10th or 15th of the month)

- Consider your firm’s culture when determining how strict deadlines should be

- Remember that faster proforma returns enable billing to process invoices more quickly

- Balance timeline requirements while allowing sufficient review time

Simplifying the Review Process

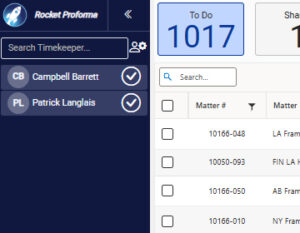

Setting tight turnaround expectations requires the review process to be straightforward and intuitive. Key elements include:

- Providing clear proforma lists that help attorneys identify and prioritize their work

- Enabling delegation to legal administrative assistants who can edit on attorneys’ behalf

- Implementing automated reminders for outstanding items

- Giving reviewers visibility into the full process status

While establishing streamlined review processes is essential, firms must also ensure these processes can scale effectively to handle high volumes of proformas each month.

Managing High Volumes Effectively

Supporting Different User Needs

Remember that attorneys want to focus on practicing law rather than administrative tasks. Systems that help automate the billing process should:

- Minimize time spent on administrative work

- Be intuitive enough to use with minimal training

- Allow delegation to support staff when needed

- Provide clear visibility into outstanding items

- Include automated reminders to stay on track

Enabling Billing Team Efficiency

For billing coordinators managing high volumes, key requirements for proforma automation solutions include:

- Automation of routine, repetitive tasks

- Ability to reassign work when team members are out

- Visibility into upcoming workload based on attorney progress

- Tools to monitor coverage and resource requirements

- Easy identification of bottlenecks or delays

Maintaining Quality Control

Implement robust quality control processes that:

- Automate routine validation checks

- Flag items requiring special handling or review

- Enable quick identification and correction of errors

- Monitor compliance with firm policies and procedures

- Track error rates and patterns to identify training needs

- Provide feedback loops for continuous improvement

With processes and quality controls in place, technology enables the consistent execution of these workflows at scale. The right technology solution can automate manual tasks while maintaining necessary controls.

Leveraging Technology Effectively

Key Technology Requirements

Look for pre-billing automation solutions that provide:

- Simple, intuitive interfaces requiring minimal training

- Flexible delegation and routing capabilities

- Automated upload of edits to eliminate manual re-keying

- Comprehensive workflow configuration options

- Strong reporting and analytics capabilities

- Mobile-friendly approval processes

Getting Value from Analytics

The right technology can transform your billing data into actionable insights. Key reporting capabilities should include:

- Processing time analysis by attorney, practice group, and office

- Financial metrics like write-offs and collections

- Workflow bottleneck identification

- Trending analysis to track improvement over time

- Resource allocation and workload monitoring

Some valuable metrics to track include:

- Time from proforma generation to attorney return

- Time from return to invoice generation

- Write-off patterns and approval flows

- Matters held multiple months without billing

- Individual and team processing volumes

- Exception rates and resolution times

Understanding these metrics provides the foundation for continuous improvement. With data-driven insights, firms can take concrete steps to optimize their billing processes.

Moving Forward

Improving high-volume billing processes requires a careful balance of efficiency, accuracy, and control. First, focus on standardizing and automating your core workflows while maintaining flexibility for unique requirements. With clear processes, supporting technology, and change management, firms can significantly streamline their billing cycles while maintaining quality and compliance.

Success often comes from:

- Starting with 80% of standard workflows before addressing edge cases

- Securing firm leadership support for process changes and deadlines

- Providing intuitive tools that minimize attorney administrative time

- Using analytics to demonstrate improvement and guide optimization

Most importantly, remember that billing efficiency directly impacts firm cash flow and profitability. Investing time in process improvement can deliver significant returns through faster billing cycles, reduced write-offs, and improved cash flow.

Measure your success through:

- Reduced time from proforma generation to invoice

- Decreased manual data entry and error rates

- Improved visibility into billing status and bottlenecks

- Higher user satisfaction with billing processes

- More timely submission of proformas

- Better compliance with client billing requirements

By taking a methodical approach to improvement and focusing on core data flows, firms can transform their billing processes from a monthly challenge into a streamlined operation supporting timekeepers and firm objectives.

Optimize Your Firm’s Billing with Datolite Rocket

Datolite Rocket simplifies proforma and prebill review, giving law firms greater visibility, efficiency, and control over their billing operations.

Explore how Datolite Rocket can help:

- Improve accuracy and reduce manual effort

- Accelerate billing cycles and cash flow

- Gain actionable insights to optimize operations

Ready to modernize your firm’s billing? Contact us today.

About the Author

Jim Lafferty is the Director of Paperless Billing Solutions at Datolite Solutions, where he helps law firms improve their billing processes with better technology. He works with firms to move from manual to automated billing, making the transition smoother and easier for staff to adopt.

Connect with Jim on LinkedIn.